Not sure how much you spend to obtain new customers? Calculating and reducing your customer acquisition cost is a great way to streamline your marketing. Keep reading for 5 easy ways to achieve it.

Acquiring customers isn’t easy. Especially when you’re generating leads or you need to score high-value repeat customers.

As with any marketing metric, the first step to improving it is understanding what’s currently working.

By reflecting on where you are, you can take steps to improve your performance as you’ll have solid insight into where needs improvement and what is performing well.

But how do you go about reducing customer acquisition cost?

In this blog, we’re going to break down:

Let’s get stuck in!

Customer acquisition cost, or CAC, is the approximate total cost needed to get a new customer. This cost considers all costs including the amount spent on marketing campaigns, tools and ad spend. It can also consider the salaries of your marketing and salespeople too.

It’s a vital metric to measure as it indicates if you’re spending too much to acquire new customers in comparison to the cost of your product or service.

This is vital as if you can lower your CAC then you can scale and grow at an elevated rate.

Ideally, the value of a customer should be three times more than the cost of acquiring them.

If the ratio is 1:1, then you know you’re spending too much. And, if it’s too high, then it could signal that you’re not spending enough and so are limiting your growth.

Calculating your customer acquisition cost is easy. Simply divide the total cost of your marketing and sales efforts by the number of customers acquired.

This figure will give you a clear picture of how much it costs you to generate a new customer. But remember, this takes your entire marketing into account. Ideally, you would calculate this number for each of your channels and campaigns to get a better understanding of what works best.

Leading on from CAC is CAC:LTV. It sounds complicated, but it isn’t, we promise.

CAC:LTV is simply a ratio that compares your customer acquisition cost to the average lifetime value of a customer.

This ratio allows you to get a better understanding of how much you’re spending compared to how much you’re generating in the way of new business. Ideally, you should be aiming for a ratio of 3:1.

If your ratio is too low, it indicates that you’re probably spending too much, while if it’s too high it highlights an opportunity to drive more business by increasing your spend.

If you’ve noticed that your customer acquisition cost is a little high, then you might want to consider some ways to reduce it.

Here, we go through some easy ways to get started with reducing your customer acquisition cost.

📈 Pro Tip

Most of these methods rely on using a marketing attribution tool. Check out how Ruler attributes revenue to your marketing.

Marketers often have to deal with their data being in silos. It’s hard to connect anonymous sessions on your website to your leads and your sales.

But, if you can bridge this data gap, then you stand to gain huge insights that’ll help you reduce your CAC.

Related: How to prove marketing impact on sales

Let’s use an example.

You set live two ads for your business. One is on Facebook, the other is on PPC channels.

Your Facebook ad drives 100 new leads at a cost of £500. Your PPC ad also drives 100 leads at a cost of £500.

Now from this data, you would assume that these ads worked equally well.

But a lead doesn’t guarantee a sale.

Your Facebook ad actually only generated 5 new customers while your PPC ad generated 20. If they all spend the same amount, that’s a significant difference between the two.

Let’s work out cost per acquisition for each.

For Facebook, your CAC is £100 per new customer, while for PPC it’s £25. That’s a massive difference of £75 meaning you would be wasting huge amounts of budget by continuing your Facebook ad.

⚡️ Pro Tip

Not sure how you would find this out? Marketing attribution is the missing link to connecting revenue back to your marketing.

Learn more about how Ruler connects the dots or download our guide to marketing attribution to learn the basics.

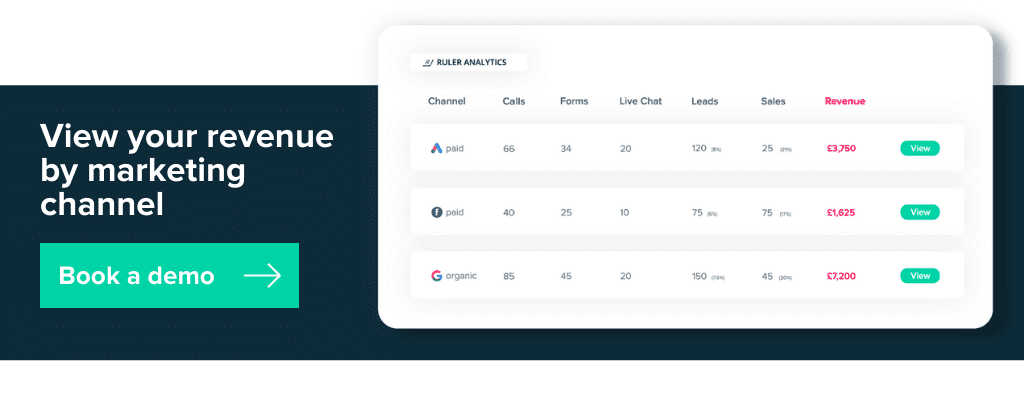

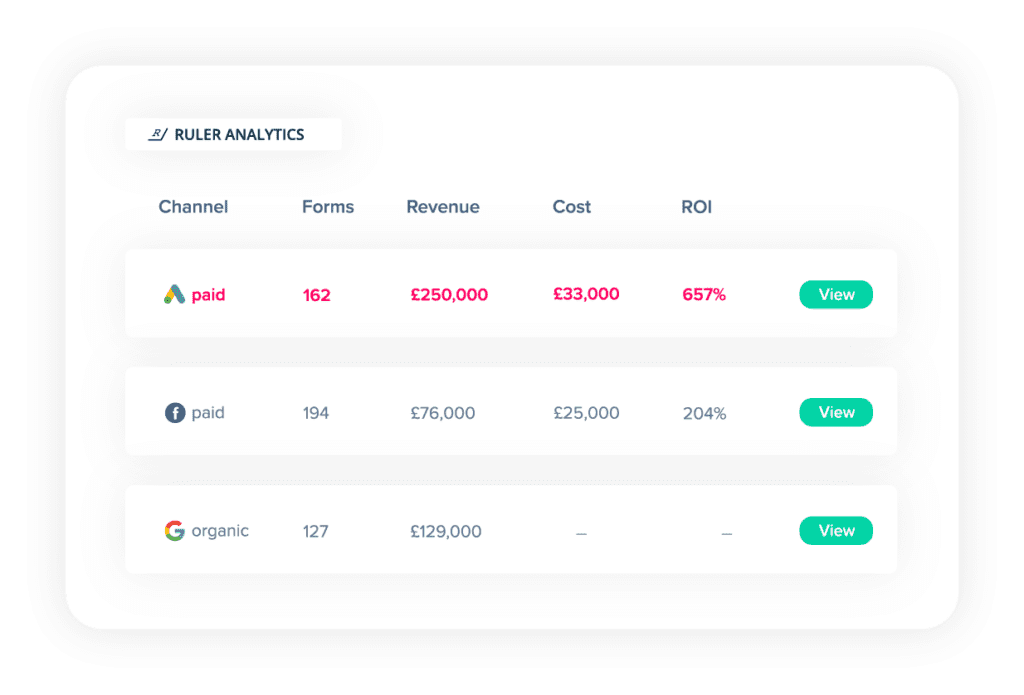

In Ruler, you can get a clear view of exactly how much value your marketing is creating.

You can use a whole range of reports to critically assess how your marketing is driving new leads, clicks and sales.

Related: Everything you can see in Ruler Analytics

When you’re marketing, particularly on paid channels, you need to be sure you’re targeting the right people.

While you want to drive as many leads and customers as possible, in the SaaS world particularly, you need to drive users who are going to stick around for longer too.

Related: SaaS metrics you need to track

Break down your buyer personas and understand your niche. While you’ll have a wider target market audience, you’ll also have a much more focused and niche target audience too.

By understanding your target audience on a deeper level, you can share more personalised content with each. After all, consumers are 83% more likely to share their contact details with a business in exchange for a more personalised experience.

This one’s more for businesses looking at their CAC to LTV. While you’ll have an initial sale from a customer, what about repeat customers?

Repeat customers spend 67% more in the third year of their relationship with a company than they do at prior stages.

We know it costs more to attract customers than it does to retain them. But we bet you didn’t know that small increases in customer retention can actually lead to 25-95% increases in profit.

Identify traits and characteristics of customers that stay on and use this knowledge in your marketing.

5 easy ways to reduce churn include:

✏️ Note

In case you were wondering, Ruler doesn’t just track every touchpoint up to the point of sale. It continues to track that user, adding every touchpoint to their customer journey.

This is helpful when you’re looking to reduce churn as you can see how customers who you know don’t churn, engage with your site at every stage of their customer journey. This will make it easier to find similar customers in the future.

There are so many opportunities out there for marketing. From new channels to new content, there are plenty of ways you can drive interest in your product or service.

You might have identified what works well in your marketing.

But there are plenty of other ways you can drive new customers too. Make sure you test these out and be quick to assess how they perform.

You could find new ways to drive new business for a much lower cost, thus reducing your CAC.

Say you want to test TikTok. You might (and your manager will definitely) want to see clear ROI straight away. With a tool like Ruler, you can quickly prove what impact your channels and content are having on your bottom line.

Related: How to definitively prove your ROI

Your sales funnel is how a company manages a customer’s buying process. The sales funnel is how you guide people from being leads to paying customers and they’re essential for when you want to reduce customer acquisition costs.

Related: Sales pipeline metrics you need to track

You can analyse where leads are dropping out in the sale process and identify key reasons that this might be happening.

Are you driving lots of leads, but they’re not converting past that point? Perhaps you need to look at any marketing automation you have set up or analyse how your sales team are reaching out to them.

Or perhaps leads are getting close to closing and then dropping off. Perhaps you need to assess your price point, onboarding or other processes to make it as easy as possible for users to convert.

Critically assessing your sales funnel will give you set changes you can implement, and test, to see how your CAC is impacted.

And there you have it. Five ways you can reduce your customer acquisition cost and supercharge your marketing and sales processes to drive even more revenue for your business.

Remember, revenue is key to helping your business. In order to generate more revenue, you need to know what’s working to drive it and optimise accordingly.

Not sure how to get revenue in your marketing reports? Read more about revenue attribution here.

Want to see Ruler in action? We can’t blame you. Book a demo to see exactly how it pulls data across sources to give you a holistic and granular view of how your marketing drives direct impact on your bottom line.