Working in SaaS and wondering how to scale your business? We spoke to SaaS industry experts for the key SaaS metrics to track when it came to reporting.

SaaS companies have all the challenges as other B2B and lead generation companies. But they also have the added challenge of creating monthly recurring revenue.

Generally speaking, SaaS companies operate on a subscription basis. That means monthly revenue in exchange for a product or service.

If you work in marketing or sales in a SaaS business then it’s tricky because you’re not trying to get as many one-off payments as possible. You’re trying to get as many customers as possible who will last as long as possible.

Sadly, much of the data we need to properly assess where our best customers are coming from is fragmented and siloed within apps. It makes it incredibly difficult for marketers to optimise their outputs to drive more revenue.

We’re a SaaS company ourselves. So, we decided to share how we find our best value customers, using key SaaS metrics and data analytics. We also reached out to experts in their space to find out which metrics they use when it comes to monitoring their business performance.

Keep reading to learn:

Let’s get stuck in.

Data is an important commodity for any business. It helps you understand what’s working well, what isn’t and how to implement positive changes.

For SaaS businesses, this challenge exists. But on top of that, they also have to contend with a pretty unique business model.

Unlike other industries that rely on one large, upfront payment, SaaS relies on smaller deposits of revenue to scale business.

So, while other B2B businesses just have to contend with driving high-quality leads (and that’s difficult enough already), SaaS has to drive new leads each month and encourage those new clients to stay on. And, even better, to increase their monthly revenue.

But while it’s difficult, it doesn’t mean it’s impossible. Look at major players like HubSpot, Salesforce and Hootsuite.

Finding your niche and encouraging growth through an aligned sales, marketing and customer success team is the best way to scale your SaaS business.

But to get started with that, you need data. That’s data on:

And much more.

With this data at hand, you can optimise your output to see greater results.

Before we dive into the metrics most voted by SaaS leaders, we wanted to share our own insights.

As a SaaS company ourselves, we could struggle with finding our most valuable customers. But we don’t.

And the reason why is simple.

We use our own product to illuminate what works best for us. And with that data, we double down on what works and stop what doesn’t.

Let us explain.

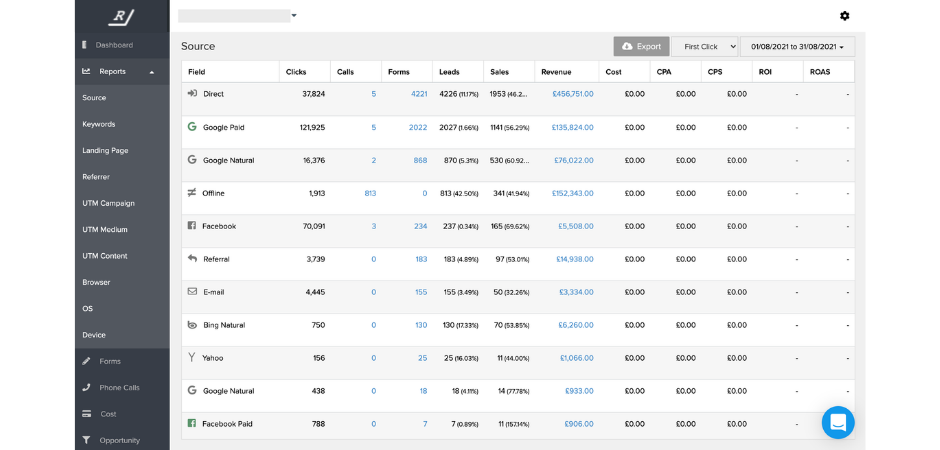

Here is a sneak peek of our product. In case you didn’t know, it’s a marketing attribution tool.

It connects the dots between anonymous website visitors, our leads in our CRM and our data in tools like Google Analytics, Google Ads, Facebook Business Manager and more.

As an example, here’s the source report. As you can see, it lists all of our marketing channels and the number of clicks, leads, sales and revenue each has generated.

This report, and others like it, have allowed us to identify where our most valuable customers have come from. And from there, we’ve been able to double down on the initiatives that are creating those customers, and stop those that aren’t.

Read more about how Ruler can attribute your revenue to your marketing, or book a demo to see it in action. But first, here’s our breakdown of the best SaaS metrics to track for your business.

We’re a SaaS company. And, we’re one that helps other companies make sense of their data and get stronger metrics to help drive more revenue. So, it only made sense to delve into the best SaaS metrics out there.

Related: How Ruler attributes closed revenue back to marketing channels and campaigns

So, we spoke to experts in the SaaS industry to learn more about which SaaS metrics they track and why they’re important.

Let’s get stuck into the 17 top SaaS metrics.

1. Customer Lifetime Value (CLTV)

2. Customer Retention Rate

3. Customer Acquisition Cost (CAC)

4. Monthly Recurring Revenue (MRR)

5. Annual Recurring Revenue (ARR)

6. Churn Rate

7. Conversion Rate

8. Monthly Unique Visitors

9. Signups

10. Average Revenue per Account (ARPA)

11. Marketing Qualified Leads (MQLs)

12. Return on Investment (ROI)

13. Average First Response Time

14. Product Qualified Leads (PQLs)

15. Net Promoter Score (NPS)

16. Number of Active Users

17. CAC:CLTV

Table of Contents

Customer lifetime value is one of the most important metrics for understanding your customers long-term staying power. Bram Jansen, Chief Editor at vpnAlert describes it as the way to “assess the benefit derived from a long-term consumer partnership with your business. This metric helps you to determine which channel is most effective at attracting the most consumers at the best price.”

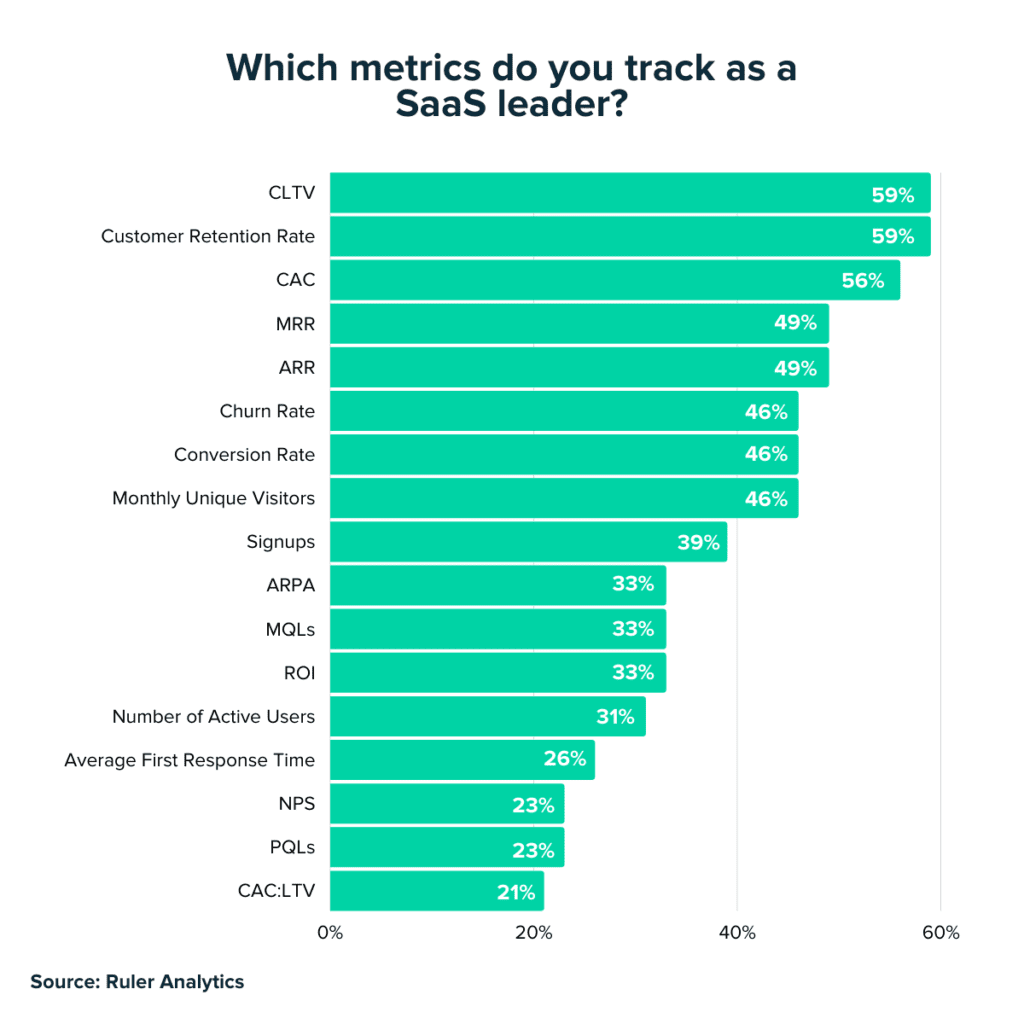

We found that 59% of SaaS marketers measure customer lifetime value as part of their regular reporting. In fact, 43% stated CLTV was one of their three most valuable SaaS metrics.

Miklos Zoltan, CEO & Cybersecurity Researcher at Privacy Affairs explained why: “Understanding the financial value of each customer is critical. CLTV enables us to better predict future marketing activities and boost our bottom line.

“Our profitability has improved by 7% in a year since we started using this KPI. We better manage our marketing budget and other customer acquisition activities by spending less money on clients with lower CLTV. To increase our CLTV, we set loyalty goals and concentrate our efforts on maintaining customers and increasing our referral network.”

And he wasn’t alone. Cody Miles, Founder and CEO at Ashore added, “In the B2B SaaS space, we measure the health of a company by the customer lifetime value; the longevity and unit economics of customers are indicative of whether our product satisfies their needs. Beyond this, it costs less to keep a customer than it is to acquire new ones. When CLTV is the base metric for success, all customers – present and future – benefit.”

Customer acquisition cost (CAC) is quite simply the average cost it takes to acquire a new customer.

But remember, there isn’t a universal figure for this as it will depend on your product cost. However, Lily Ugbaja, Founder of Mombabyheart suggested, “A reasonably good ratio to aim for is 3:1. That means the value of every customer gotten should be 3 times more than the cost of acquisition. If the ratio is 2:1 or even 1:1, then your CAC (customer acquisition cost) is definitely too high.

Related: How to reduce your customer acquisition cost

This metric is very important as it helps a business calculate the value and importance of a customer compared to the costs spent on marketing and research.”

56% of SaaS businesses reported measuring their cost per acquisition in reporting. And 44% stated that CAC was one of their most important metrics.

Aaron Agius from Louder Online agreed, “If you can precisely measure and track the average customer lifetime value, then you can make your marketing efforts work around that. Spending $500 to get one customer isn’t worth it if they’re committing $500 per year.”

Customer retention rate (CRR) is an important metric as “having a client on our roster for a long time is a sign of good customer service”, said Michael Robinson, Security Expert at Cheap SSL Security.

We found that 59% of marketers agreed with him, using customer retention rate as a key metric in their regular reporting. In fact, 30% of those surveyed stated CRR was one of their most valuable metrics as a SaaS company.

Edward Mellett, Founder at Wikijob.uk said, “For me, customer retention rate is most valuable because it increases the lifetime value of your clients and increases the sales. It also aids in the development of fantastic customer relationships. They trust you with their money because you provide them with something of worth in return.”

Sam Browne, CEO and Co-Founder of Find a Band, agreed, “Customer retention rate is an important KPI (and this may seem self-evident) but treating customers well is by far the most successful way to keep them loyal. Provide good services at a fair price, provide friendly customer service at all times, and respond to complaints as quickly as possible. Give the customer a reason to trust you by being honest.”

49% of those surveyed stated that they regularly tracked monthly recurring revenue (MRR). And we can’t blame them. Understanding your monthly incoming revenue allows you to predict your incoming revenue and create a baseline.

Related: Foolproof guide to increasing your MRR

By knowing how much you’re generating per month, you can start to create targets to grow your inbound revenue. Thomas Smale, CEO and Founder of FE International added, “MMR is the lifeline of your SaaS business, as recurring revenue is the centre of your business model. For any SaaS business, it’s vital to know how much it costs to convert a potential lead into a customer, as it’s a key to scaling profitability.”

33% of the experts we spoke to listed MRR as one of their top three metrics when it came to tracking their SaaS company. So it’s clearly viewed as essential as it “allows you to forecast the company’s future cash flow and budget. To plan and control growth, spendings, and earnings, it’s crucial to stay up-to-date on this metric” added Marcin Stoll, Head of Product at Tidio.

Janice Wald, Freelance Blogger at MostlyBlogging said, “First, we try to boost our monthly income. Unless we track it, we won’t know if this goal is met. Tracking this metric helps you know if your efforts are working effectively. Also, if you want to increase your overhead, you won’t know if you can afford it.”

At Ruler, we use ChartMogul to better understand our incoming monthly revenue. But it doesn’t stop at inbound sales. We can also track any churn, upgrades or contractions to get a good sense of our projected end month by month.

Related: How Ruler Analytics uses ChartMogul to close the loop between marketing and customer revenue

Similar to MMR is annual recurring revenue (ARR). This is exactly the same as MRR except, you guessed it, revenue is viewed on an annual basis. “The numbers can be useful in budgeting for future expenses but are also the main drivers used to measure your business growth”, Oliver Andrews, Owner at OA Design Services commented.

We found that 49% of our SaaS experts regularly tracked ARR but just 15% counted it as one of their top three metrics.

Jennifer Foster, Managing Editor at Authority Astrology added, “ARR is the amount of revenue that a business anticipates repeating; it permits tracking of progress and forecasting future development.

“It is a valuable statistic for determining momentum in areas such as new sales, renewals, and upgrades – as well as losing momentum in areas such as downgrades and lost clients.”

Churn rate is a common metric for those operating under a subscription service. “When a customer cancels their subscription to your service, it is called churn. Your churn rate is the percentage of your customers who leave in a given period. The churn rate is usually measured monthly” commented Olive Andrews, Founder of OA Design Services.

We found that 46% of our experts regularly track churn rate while 36% counted it as one of their top three metrics to track in the SaaS space.

Keeping an eye on churn allows you to better understand the sentiments of your customers. Dimitris Tsapis, Head of Growth at PlanM8, said, “Keeping an eye on our churn rate helps us uncover any patterns that could be affecting our customer satisfaction. This is important for us to track as our business generates revenue from customers that are on a recurring payment plan. By grasping the CCR trends we can link these changes to different initiatives within the company that had an impact on customer satisfaction. From understanding what has led to these changes and having an agile approach we can adjust our efforts to improve our customer satisfaction (e.g. if the CCR goes up, we can analyze and identify the issue while doubling down on our efforts to ensure that the customers get the best customer experience possible).”

For Phil Crippen, CEO at John Adams IT, churn rate allows you to answer this specific question: “‘Is my SaaS business good at holding onto customers for the long-term?’

“Once you access the churn rate results, your organization can determine the reasons why some of the customers are moving on. You’ve got to use this KPI metric every single month to stay on top of how many SaaS customers you’re losing.”

Even more specifically, you need to understand why your customers are churning and take steps to remove any potential causes of churn.

Conversion rate is a common KPI used by many marketers to understand how much traffic is converting into leads, or sales.

Marketing is a key facet of driving and scaling businesses. And this is no different for those in the SaaS space. Alexandra Zamolo, Head of Content Marketing at Beekeeper added, “Our marketing efforts are extremely important to us, therefore it’s equally as important to keep an eye on our conversion rates. If our leads aren’t converting from a visit to our site, then that means that we need to make a pivot.”

46% of SaaS experts agreed that they regularly tracked conversion rate (to customer) as part of their reporting. 28% stated that conversion rate was one of their most important stats when it came to measuring the performance of their SaaS company.

Related: Learn how to track your revenue attribution correctly

But for us, it goes beyond just lead conversions. You also need to be looking into your conversion rate to revenue.

💡 Pro Tip

We analysed our own data to find the average conversion rates for the B2B tech industry. Check it out and see how you compare.

Monthly unique visitors is a count of the number of unique users of your website in a month. If someone visits multiple times within one month, they will still only be counted once.

Related: How we improved our domain rating

While this isn’t hugely insightful, it does give a good indication of your audience size. Alina Clark, Growth Manager & Co-Founder of CoCoDoc said, “The quality of traffic to our site is as important as the quantity. Even though the monthly unique visitors don’t really provide any new insights, it shows the size of our audience, and how well our marketing is doing. The monthly unique visitor count shows how our top-of-the-funnel conversion is doing.”

And if your main driver of traffic is content marketing, then you can be sure that tracking your website performance is key. Felix Bodensteiner, CEO at TableLabs added, “Tracking monthly unique visitors highlights if we are attracting a relevant, and growing, audience, or not.”

While you want to keep your lead funnel full, your website plays a role in that too. Driving more high-quality traffic to your site will result in more leads and sales.

Related: What is lead value and how to track it

So, it’s no surprise that 46% of our experts in the SaaS industry stated they regularly report on the monthly unique visitors. However, just 8% cited it as one of their most important statistics. So, while it does clearly make a useful addition to your reporting, it’s evidently not crucial to your business.

Signups aren’t going to be relevant for every SaaS business as not all of them will offer a trial or freemium version of their product. However, it’s important to remember the role that self-service can play for a SaaS business when done correctly.

With a trial or account signup as a goal, marketing has a clearly defined goal to aim for. More signups should mean more revenue (if your product is what that user is looking for). We found that 39% of the SaaS experts we engaged with reported on signups. But, just 15% stated it was one of their most important metrics as a SaaS business leader.

Alina Clark from CoCoDoc, added, “As a self-service Saas company, signups are the most important of our metrics. The number of signups is the determinant for our conversion. A high number of sign-ups shows us that we’re doing great. On the other hand, a drop in signups means that our content marketing isn’t doing great.”

Average revenue per account (ARPA), also known as average revenue per user (ARPU), is a measure of the revenue generated per account. Usually, it’s calculated on a monthly basis but you can always calculate it yearly or quarterly depending on your business operations.

You can calculate your ARPA by diving your MRR by the number of active customers. We found that 33% of our SaaS leaders track their ARPA. Just 10% placed it as one of their most important metrics.

Phil Crippen, CEO at John Adams IT believes that ARPA is the best metric for his company, however, as “it refers to the total cash received within a specific time frame. Of course, without enough cash, any company will go out of business. Businesses should break down revenue into the following sectors:

By getting a grip of your numbers, you can confidently predict your future growth and identify opportunities for expansion. And, remember, as your company grows and changes, so will your numbers. John Bertino, CEO at The Agency Guy advises, “to estimate ARPA separately for current and new clients so you can see how your ARPA is changing or whether new clients are behaving differently than existing ones. In order to distinguish the influence of upselling from the actual price at the start of closing a new client, some business owners may estimate this as their average sales price.”

Marketing qualified leads, or MQLs are leads who have expressed an interest through marketing channels or campaigns. That could be a download of an eBook or signup to your newsletter. These are great ways to track how your marketing efforts are helping to drive leads.

33% of SaaS leaders measure the number of MQLs but just 2.5% think MQLs are in the top three most important SaaS metrics.

Remember, though, not all leads are created equally. Aaron Agius, Co-Founder of Louder Online, said, “It’s important to have accurate data on MQLs to extract the best value from marketing. If you can consistently identify and chase down the hottest leads, your SaaS will grow.”

And he’s right. But how do you know what a ‘hot lead’ is? Often it requires a lot of hard work from a sales team to determine a lead’s quality. But the truth is, some channels and campaigns drive better quality leads than others. And wouldn’t you want access to that data?

Using Ruler Analytics, you can. With marketing attribution software like ours, you can link your closed revenue back to your marketing channels, campaigns and even keywords. You can optimise your marketing based on what’s driving MQLs who go on to convert into revenue. After all, isn’t revenue one of the best metrics for success?

Related: Learn how to track your lead value through the customer journey

Return on investment (ROI) is the value you need to understand how your work is impacting your bottom line. For marketing in particular, if you’re not securing a high return on your investment, then you need to assess your output.

33% of SaaS leaders stated they tracked their return on investment. And, 15% stated it as one of their top metrics to measure.

Related: 5 best ROI tools for marketers

But there are difficulties with tracking ROI. Especially for those in the SaaS industry.

💡 Pro Tip

Ruler supports SaaS companies to attribute sales back to the influencing marketing channels, campaigns, ads and keywords. See how it works to track users through your full customer journey with our guide to tracking touchpoints

Not all metrics for SaaS are sales and marketing-driven. Some highlight the impact of customer success too.

Average first response time is how quickly your customer services team responds to queries, questions and complaints from customers. But remember, while it’s important to answer quickly, it’s also important to resolve issues quickly too. So, you might want to make a note of your average resolution time too.

26% of SaaS leaders measure their average response time. However, just 5% cited it as one of their most important metrics to measure.

Product qualified leads (PQLs) are the new MQLs for some SaaS businesses. Remember when we mentioned signups. PQLs are signups can be differentiated like this.

A signup is just a signup. A PQL is a signup followed by a series of engagements from that user. The difference is the intent to continue to use a product. As such, definitions for PQLs will vary business to business.

And, we found that 23% of SaaS leaders measure PQLs. This might seem low, but remember, it’s not going to be relevant for everyone.

Customer satisfaction is key to ensuring low churn. One way to measure that is through customer surveys. The net promoter score (NPS) is the most popular metric for customer satisfaction.

It’s usually seen as a pop-up on a website where users can share how likely they are to recommend that product. The NPS will be a range, usually 0-10, and will help indicate how happy users are.

We found that just 23% of SaaS businesses measure their NPS. And, just 7% stated that NPS is one of their most important metrics.

If you’re selling a SaaS product, you want a high percentage of your customers to be active users ie. frequently using your product. But since each SaaS is different, there’s no measure of what’s ‘good’ and what’s ‘bad’ when it comes to a number of active users.

It could depend on your product type. For example, Ruler acts as a go-between all key marketing apps like Google Analytics, CRMs, Google Ads, Facebook and more. So, we wouldn’t be surprised to see a lower number of active users as our product is about firing data where it’s needed.

30% of SaaS businesses stated that they report on their number of active users. But just 10% declared it was one of their top three metrics to track.

21% of SaaS businesses state that they report on their CAC to CLTV ratio. That’s the act of comparing your customer acquisition cost and customer lifetime value as a ratio. David Skok states that your LTV should be about three times your CAC for a viable SaaS company—or any other form of recurring revenue model.

Related: Quick breakdown of LTV:CAC

And Cody Miles, Founder and CEO of Ashore, took it further, “To put it simply, if our LTV is not 6x higher than our CAC, we know we’re moving in the wrong direction – both in terms of marketing and operations.”

It’s worth remembering that CAC and CLTV came out top as most tracked SaaS metrics. Marcin Stryjecki, PM SEO at Booksy, said, “For any SaaS, LTV and CAC are the most important metrics to track. They tell you about how much a customer can generate across their entire time using your service, as well as what the cost of acquiring your customer is.”

While CAC and CLTV came out on top, comparing these two stats together can help you get a whole new perspective. This ratio tells you how profitable a customer will be over their lifetime.

So now you know a bit more about the key SaaS metrics that are available to you. But, you might have spotted something.

With all of these, a good handle of your data is a must.

Let’s take CAC for example. To calculate this, you need to be able to attribute closed revenue to a particular marketing source. And it’s difficult to achieve this without marketing attribution.

Remember, revenue, CAC and CLTV came out as some of the strongest metrics for those in the SaaS industry. In fact, Petra Odak, Chief Marketing Officer at Better Proposals stated that “if your CAC, LTV and churn are good, you have little to worry about.”

So, get more out of your SaaS by improving your data.

Ruler’s mission is to support businesses improve their data. We connect your sales and marketing data using our closed-loop marketing attribution software.

You can learn how Ruler works by booking a demo with our team. Or, we’ll guide you through the process of closed-loop marketing attribution (that’s connecting your sales to your marketing) with our easy guide.